In ancient mythology, Chinese unicornsare lucky, rare creatures that appear to mark the arrival or death of a great leader, like Confucius. Today, China's tech unicorns -- private companies valued at $1 billion or more -- are far more commonplace and look increasingly cursed.

Four of the world's seven most valuable private companies are now Chinese, all founded in the past seven years. Didi Chuxing, the ride-hailing app, and Xiaomi, the smartphone manufacturer, for instance, both have valuations topping Airbnb and Snapchat. Five Chinese companies have valuations of at least $10 billion, and 37 are valued at $1 billion or more, according to research firm CB Insights.

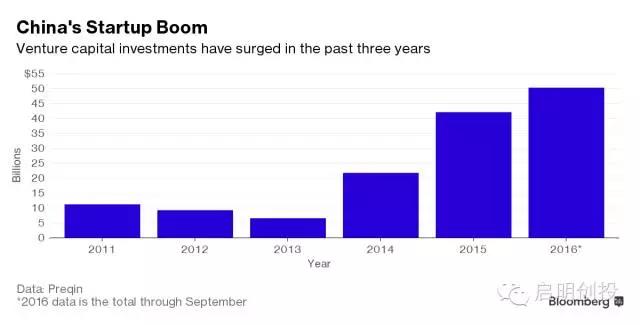

The pace of unicorn births has accelerated dramatically over the past three years. From 2010 to 2013, investors valued no more than one Chinese company each year at $1 billion or more. Then China saw five new companies deemed unicorns in 2014 -- and an eye-popping 19 foaled in 2015. In the first 10 months of 2016, investors crowned another 10 new unicorns.

Chinese companies, once derided as copycats, are now often viewed as potential global conquerors. At a technology conference earlier this year in Beijing, Uber chief Travis Kalanick predicted, "In the next five years, there will be more innovation, more invention, more entrepreneurship happening in China, happening in Beijing than in Silicon Valley." As though fulfilling his own prophecy, six months later, Kalanick announced that local rival Didi would be acquiring Uber's China operations. Wired’s UK edition featured Xiaomi CEO Lei Jun on its cover this year above the headline, “It’s Time To Copy China.”

Lei Jun.

Photographer: Qilai Shen/Bloomberg

But even as the tech universe's center of gravity seems to be shifting toward Beijing, there's growing skepticism within China about how valid some of the sky-high valuations are. In hotel conference ballrooms and over steaming hot pot dinners, investors and analysts are whispering doubts about startups' ability to maintain such lofty numbers when they try to raise future funding or go public. As top government officials and tech executives gather this week in Wuzhen for the World Internet Conference, some fret the waves of cash pouring into China’s technology industry may sometimes swamp innovation, not stir it.

"A paper unicorn is just a paper unicorn," said Jenny Lee, Shanghai-based managing partner at GGV Capital. "It's nothing until you can show the value you're providing to customers, and that consumers are willing to pay for it." Gary Rieschel, managing partner at Qiming Venture Partners, said startups are quietly beginning to accept lower valuations -- and more unpublicized down rounds are on the way. ``It's impossible that all those companies will be able to maintain their valuations,'' he said. ``Gravity will eventually take hold.''

Check out the new Bloomberg U.S. Startups Barometer

Expectations for Chinese tech companies were launched into orbit in 2014 with the initial public offering of Alibaba Group Holding Ltd., a blockbuster that raised $25 billion -- more money than any IPO in history. The e-commerce company's success made global headlines, catapulted co-founder Jack Ma to international fame and heralded the arrival of Chinese technology on the world stage.

As investors rushed to find the next Ma, the spigots of venture capital opened wide. Between 2012 and 2015, the amount of venture funding invested in Chinese internet companies quintupled, reaching $20.3 billion last year – eclipsing the $16.3 billion invested in U.S. internet companies in the same period, according to PriceWaterhouseCoopers. The ranks of professional investors swelled too: In 2000, China had about 100 registered venture capital firms; by 2015, it had more than 10,000 venture capital and private equity firms, according to Beijing-based research firm Zero2IPO.

Alibaba's Jack Ma.

Photographer: Chris Ratcliffe/Bloomberg

One of the greatest beneficiaries – or perhaps victims – of hyperbolic expectations about all things China internet is Xiaomi, the Beijing-based smartphone maker. Founded in 2010 by serial entrepreneur Lei, the startup shot to fame selling high-performance, low-cost smartphones through "flash sales" on its web site. For several months in late 2014 and early 2015, Xiaomi was China's top smartphone seller. Three months after Alibaba’s IPO, Xiaomi capitalized on the fervor with a funding round that valued the company at a breathless $46 billion, making it briefly the world's shiniest unicorn (it's now second only to Uber).

Yet its dominance proved fleeting. Over the past year and a half, Xiaomi's position in China's handset market tumbled from first to fourth. The company is certainly still a unicorn, but its current value may be $4 billion to $10 billion if it tried to raise more money now, estimated Clay Shirky, an associate professor at NYU Shanghai and author of the 2015 book, Little Rice: Smartphones, Xiaomi, and the Chinese Dream. "Over the past 18 months, they’ve lost 90 percent of their value, or thereabouts," he said.

He points to the valuations for smartphone makers with publicly traded stock. China's Lenovo Group Ltd., for example, holds about the same share of the Chinese smartphone market and is valued at about $7 billion. Lenovo is also the biggest PC maker in the world. ``Xiaomi shouldn't be six times Lenovo,'' Shirky said.

A representative for Xiaomi said the company's last equity fundraising was at a valuation of $46 billion and that there have not been further transactions since then. The company declined further comment on its valuation.

Vancl, an online fashion retailer, was the first of the current flock of e-commerce unicorns to be crowned, in December 2010. Catering to young and budget-conscious shoppers, the company’s early days looked promising. The company commanded 7.7 percent of China’s online apparel and footwear market in 2011, second only to Alibaba, according to the research firm Euromonitor. Its valuation hit $3 billion. But the company stumbled in its expansion and struggled to manage inventory. By 2015, Vancl's market share had dropped to 2 percent, while Alibaba cemented its lead and rivals JD.com and VIPShop surged ahead.

Clothing on display at the Vancl office.

Photographer: Keith Bedford/Bloomberg

``Vancl came out and had incredible customer service. They would deliver stuff for free, even 8 yuan socks,” said Shaun Rein, managing director of China Market Research Group in Shanghai. “It's a great way to build up a reputation. The problem is, they had no margins – that’s no way to build a business."

Vancl's valuation is well below its peak. Qiming was an early investor in the company and Rieschel said the company went through a recapitalization a couple years ago that valued Vancl at about $200 million. "They had great traffic, terrible execution on inventory management,'' he said. ``It's an exact example of what I think will happen with other companies. Statistically, they won't all have good execution." Vancl, which never disclosed a reduced valuation, declined to comment.

The Beijing startup Wandoujia hit the magical $1 billion valuation in 2014, amidst the euphoria over China's fast-growing smartphone market. The lead investor was Japan's SoftBank Group Corp., the same company that made a fortune from its stake in Alibaba. But Wandoujia's business of selling Android apps proved vulnerable to competition and the online store struggled to stand out. In July, Alibaba acquired Wandoujia for less than half its peak valuation, according to a person familiar with the deal. SoftBank and Alibaba declined to comment.

Even some of China's most valuable unicorns have seen their plans for world domination interrupted. Lu.com is a peer-to-peer lender valued at $18.5 billion and backed by some of the country's most powerful investors, including the finance giant Ping An Insurance Group. CEO Gregory Gibb had said in January that he planned to take the company public this year to raise additional capital. But those plans are off the table after months of tumult in the online lending market. China authorities accused a competing lender, Ezubo, of running the country's largest-ever Ponzi scheme and implemented tougher regulations, forcing hundreds of allegedly fraudulent companies including Ezubo to shut down. While Gibb said more oversight will eventually help the industry, the implementation will take time. `` In recent years, it is inevitable that the bad became mixed with the good,'' Gibb said in an e-mail. ``Some platforms have been established for fraud at the very beginning, which is extremely harmful to the development of the internet finance industry." He said the company won't discuss IPO plans for now.

Even Didi Chuxing, which became the third-most valuable startup in the world as it repelled Uber from China, has seen a regulatory shift that now threatens its expansion. The country's largest cities have proposed rules that would require drivers for private car-hailing apps to be local residents, a problem for Didi because the vast majority of its chauffeurs in places like Shanghai don't meet that standard. Didi is working with local authorities to modify or stop the regulations.

Uber Might Have The Last Laugh Over China

Bullish investors and boastful founders are hardly unique to China, of course. Silicon Valley has a long history of bubble and bust, including the historic 2000-2001 dot-com crash, and investors know that what goes soaring up may also come crashing down. Indeed, U.S. exits and financings have declined over the past year, according to a newly introduced Bloomberg startup barometer. China's much younger technology sector has never gone through anything quite so seismic. "What's different today is the scale, the magnitude of these companies and investments," said Duncan Clark, founder of Beijing-based consultancy BDA China and author of Alibaba: The House That Jack Ma Built.

The country has no real precedent for dealing with the bust of a high-flying startup, or several at once. Most domestic venture firms were founded after the last major downturn 15 years ago. There's no history of publicly disclosing down rounds, or the decrease in a startup's valuation – although investors may privately write down struggling companies. ``In the U.S., it's far more common to have down rounds,'' said Rieschel of Qiming. ``Entrepreneurs will do unusual things to avoid down rounds in China -- bring in new money with very onerous terms, or ratchets, just to keep the valuation.'' He said his firm has participated in down rounds besides Vancl, but declined to name the companies involved.

Meanwhile, China's government has exhibited an uncertain flirtation with the risks of capitalism. Last fall central authorities intervened to try to stop the stock-market slide, and this March Shanghai officials announced an unusual payback scheme for unlucky investors – offering to compensate venture firms for withered investments in local tech companies. With jobs and prestige on the line, local governments in China have often been reluctant to let even the most conventional of businesses go under. They may be even more fearful of tech startup failures, which would eliminate jobs and threaten future investments.

In a recent column, Hu Shuli, editor of the independent financial magazine Caixin, warned about the oxymoronic notion of a safety net for venture capital: "This sounds well and good, but it won't work. The policy will only reward failures." In its recent rush to promote entrepreneurship, she added, China's government is still struggling with the "balance between active involvement and leaving the market alone."

China venture capital investments surged from $6.6 billion in 2013 to more than $50 billion in the first nine months of this year, according to researcher Preqin. But in the third quarter, investments fell almost 50 percent from a year earlier. Maybe that’s a relief, at least a few investors said.

"Some entrepreneurs say they need all the money,'' said Anna Fang, Shanghai-based CEO of Zhenfund. "But some people say, if you have too much money, you make mistakes, or you make mistakes for longer." Historically, many tech champions have been founded, or burnished, during economic downturns. China's reigning internet triumvirate -- Tencent (founded 1998), Alibaba (1999) and Baidu (2000) -- all had to prove themselves during the bursting of dot-com bubble.

"How many of those 30-some unicorns are really worth a billion?” said consultant Clark. “Probably a few. The problem is that when people appear to be successful, everyone comes out of the woodwork to back them. That happens in the U.S. But it's more extreme in China."