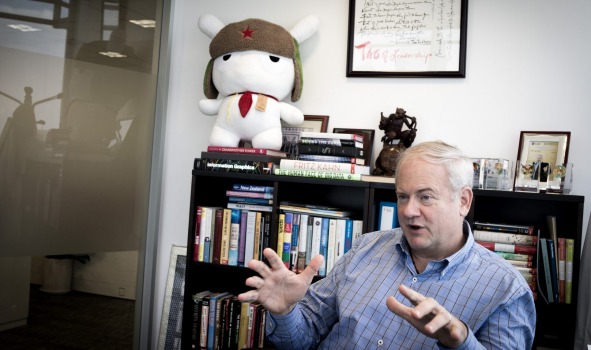

Pride of place on Gary Rieschel's bookshelf, in his corner office overlooking Shanghai's impressive skyline, is a giant stuffed bunny, dressed in a traditional Russian hat adorned with a five-pointed red star.

Surrounded by books such as Do More Faster: Lessons to Accelerate Your Startup and Export Now: Five Keys to Entering New Markets, this apparently Communist bunny looks out of place. But as the mascot for Xiaomi, arguably China's most successful start-up in the past five years, it is a cuddly reminder of why Rieschel moved here in 2005.

Qiming Venture Partners, co-founded by Rieschel months after landing in Shanghai as a retired venture capitalist looking for a break, was one of Xiaomi's earliest investors. And the move paid off. After its latest raising, the home-grown smartphone company, which is often referred to as China's Apple, was valued at more than $US45 billion ($62 billion).

While the world has been distracted by the faster-than-expected decline in China's construction-related and heavy manufacturing sectors, Rieschel has been focusing on the country's new economy industries; healthcare, technology and environmental sciences.

"I don't have any doubt that in 10 years' time, China's economy will be larger and China will be more powerful and more influential on virtually every metric than it is today," the 59-year-old American businessman says during an interview in his office.

"It absolutely will happen. But you are going to get hurt if you pick areas where it's something that China can't sustain."

Those areas include steel, cement, glass and other construction-related sectors, which after three turbo-charged decades have slowed right down as China fills up with railways, bridges and apartment buildings.

Economy facing problems

While we are talking in Rieschel's office on the 39th floor of the Jinmao Tower in Shanghai's financial district, the National Bureau of Statistics announces that China's economy grew 6.9 per cent in the third quarter, its worst result since the global financial crisis.

Rieschel doesn't pay close attention to the figures. He says of course China's economy is slowing as it gets bigger and more developed. But he notes that even at growth of 6 per cent, which is below the government's 7 per cent target for 2015, it is creating the equivalent of California's economy every three years. Every two years, it is adding the equivalent of Indonesia's economy.

Still, he concedes the Chinese economy is facing some big problems related to high debt levels and the sluggish property market and, as a result, investment decisions have become more complicated.

For Australia, China's economic transition poses a significant challenge.

"The bad news is a number of the most successful Australian industries have been related to natural resources, so you should expect those to come under pressure," he says.

"The good news is that Australia doesn't have many people, but it has a phenomenal land mass, educational resources and attraction as a tourist destination, so I think from a services economy perspective … there are pretty significant opportunities."

For Qiming – which counts among its backers the likes of the investment foundations of Princeton, Harvard and MIT, and which will have more than $US2.5 billion under management by the end of January – it means a strong focus on consumer, technology and health-related companies.

Opportunity in healthcare

Take healthcare. On Rieschel's calculations the sector accounts for about 7 per cent of GDP, worth $US700 billion. But he expects that proportion to double over the next 10 to 12 years. Based on that outlook, Qiming has invested in local companies such as clinical trial company Tigermed Consulting and hearing implant maker Nurotron, the main Chinese competitor to Australia's Cochlear.

Environmental sciences is another sector where the Qiming founder sees huge opportunity. The venture fund decided more than three years ago it would cost China a trillion dollars each to fix its land, water and air pollution problems.

"Clearly that sector is going to receive a great deal of attention," he says.

"From an investor's standpoint that's attractive, but from a citizen's standpoint the clean-up is going to take far longer than people expected it to."

In 2004, Rieschel retired, handed over management of Softbank Venture Capital to some of his partners and moved from Silicon Valley to Shanghai so his children, who were nine and seven, could go to school.

Ten years ago there were fewer than 30 of what Rieschel would regard as proper institutional venture capital funds in China, but he says there are now several hundred.

"The industry in 2005 was very young and I started to realise how few VCs here had any experience coaching entrepreneurs."

Trio of stand-out features

He began talking with Duane Kuang, who was in charge of Intel Capital's investment activities in China, and five months later Qiming was formed. They did three things that made them stand out in China's venture capital crowd. They gave all managing partners equal compensation, focused the fund on early-stage investments – three-quarters of companies in their portfolio had no revenue when they invested – and organised staff around specific sectors to ensure they built up a knowledge base.

Rieschel is optimistic about China's economic outlook, particularly the sectors Qiming invests in, but recognises the challenges. "China is a huge teenager," he says. "Physically, the country is relatively mature, strong and powerful, but it is a little too self-centred and way too insecure."

The most recent examples of these traits, he says, were Beijing's intervention in the sharemarket after it slumped by almost a third in the middle of the year, followed by the central bank's move in August to depreciate the currency without warning. "They were very immature and very insecure in how they approached that."

Even more frustrating for Rieschel is the government's control of the internet and the recent crackdown on human rights lawyers and their families, which is inconsistent with moves to open up the economy. But he takes a long-term view and says the companies he works with have "incredibly bright, driven" entrepreneurs who are changing the every day lives of Chinese people.